Trusted Credit Repair Services since, 2010.

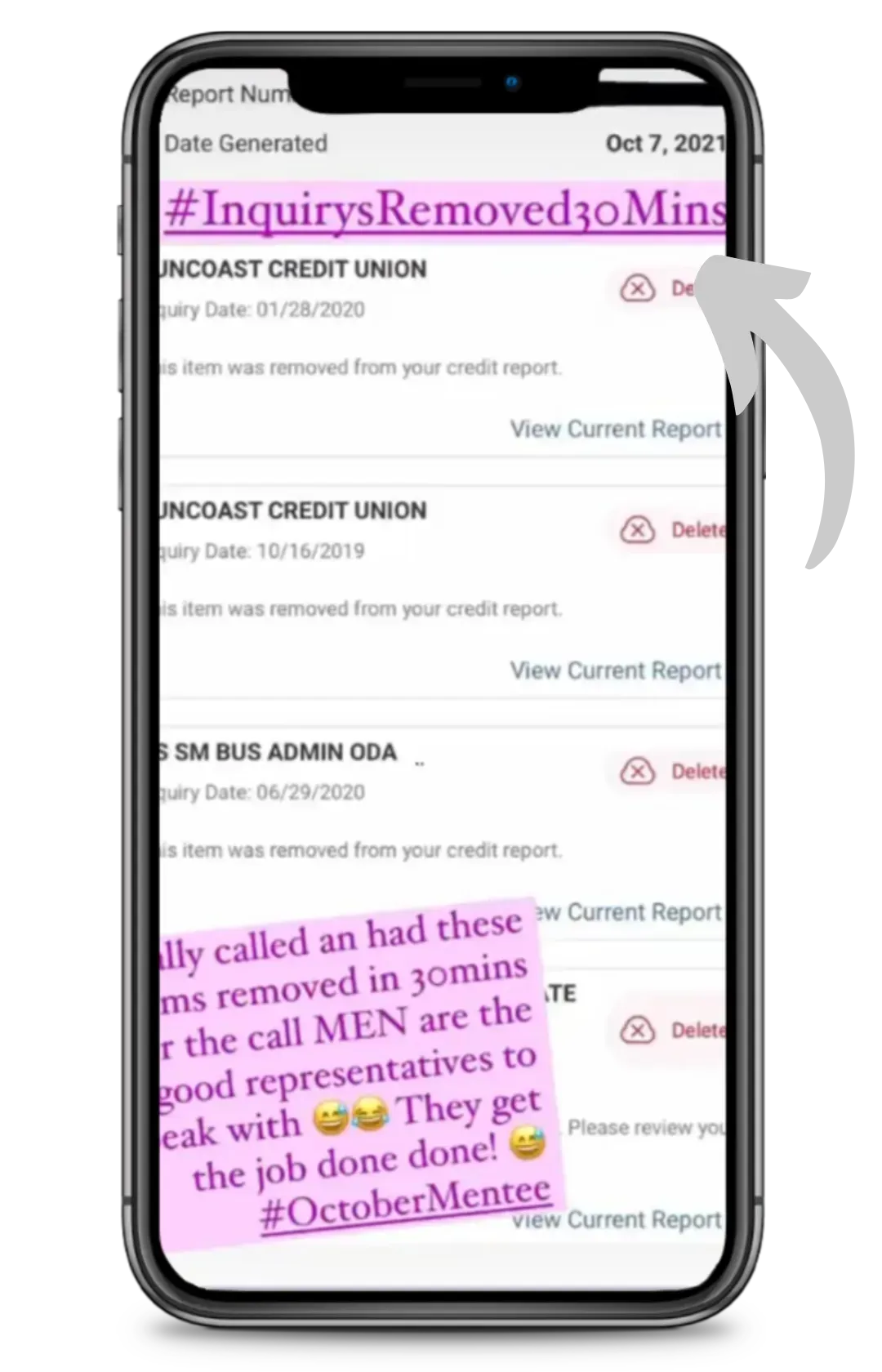

It can be hard to face your credit after a season of financial difficulty, but you're not alone. In 2021, we deleted over 2.5 million negative items for our clients. This can happen for you.

Enroll Now

$497 start-up fee

How Our Credit Consultancy Service Helps You

Custom Credit Plan

Your financial journey is unique. That's why our services are customized to fit your individual needs, providing you with a clear and personalized roadmap to navigate the complexities of your credit report.

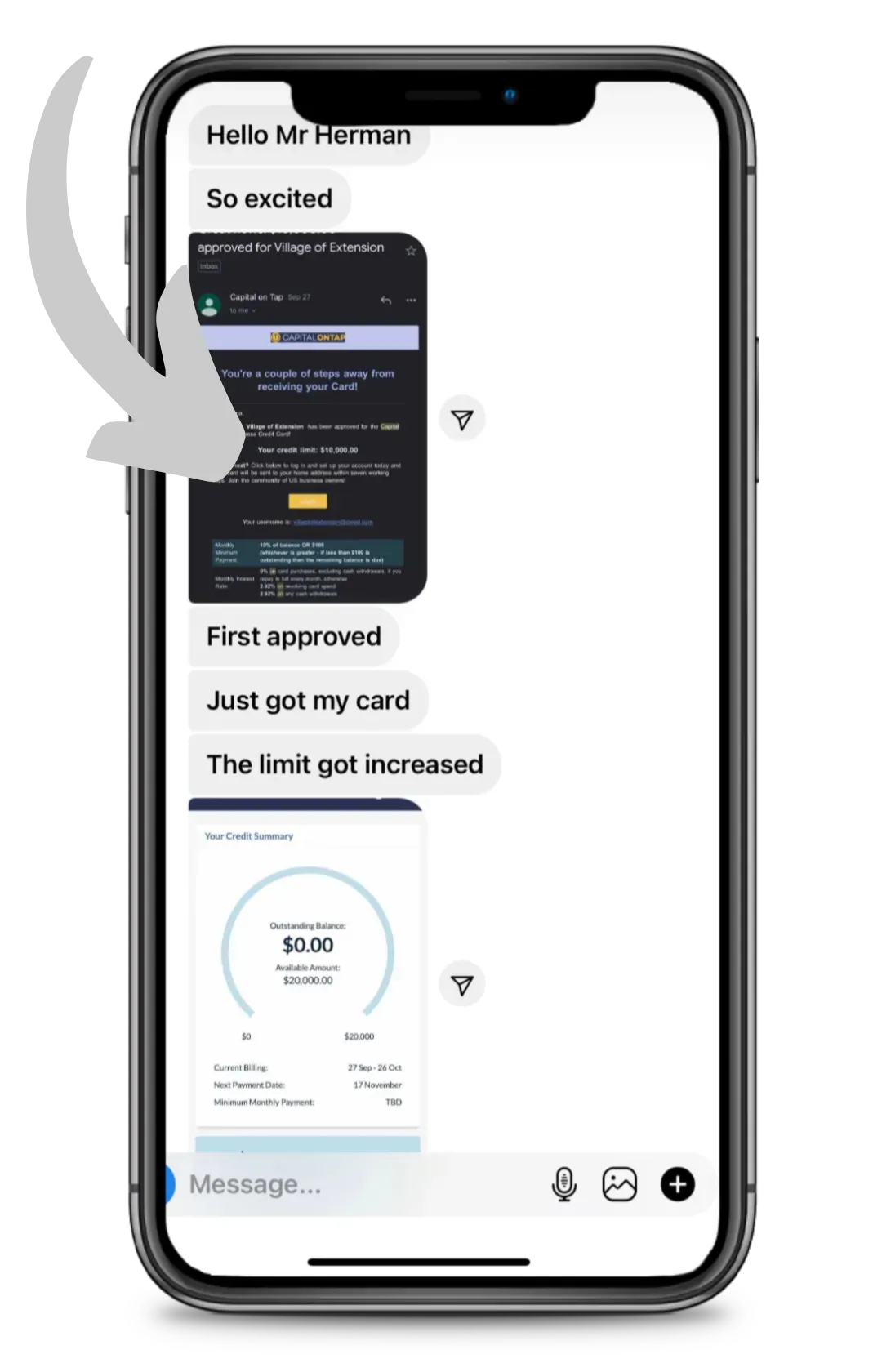

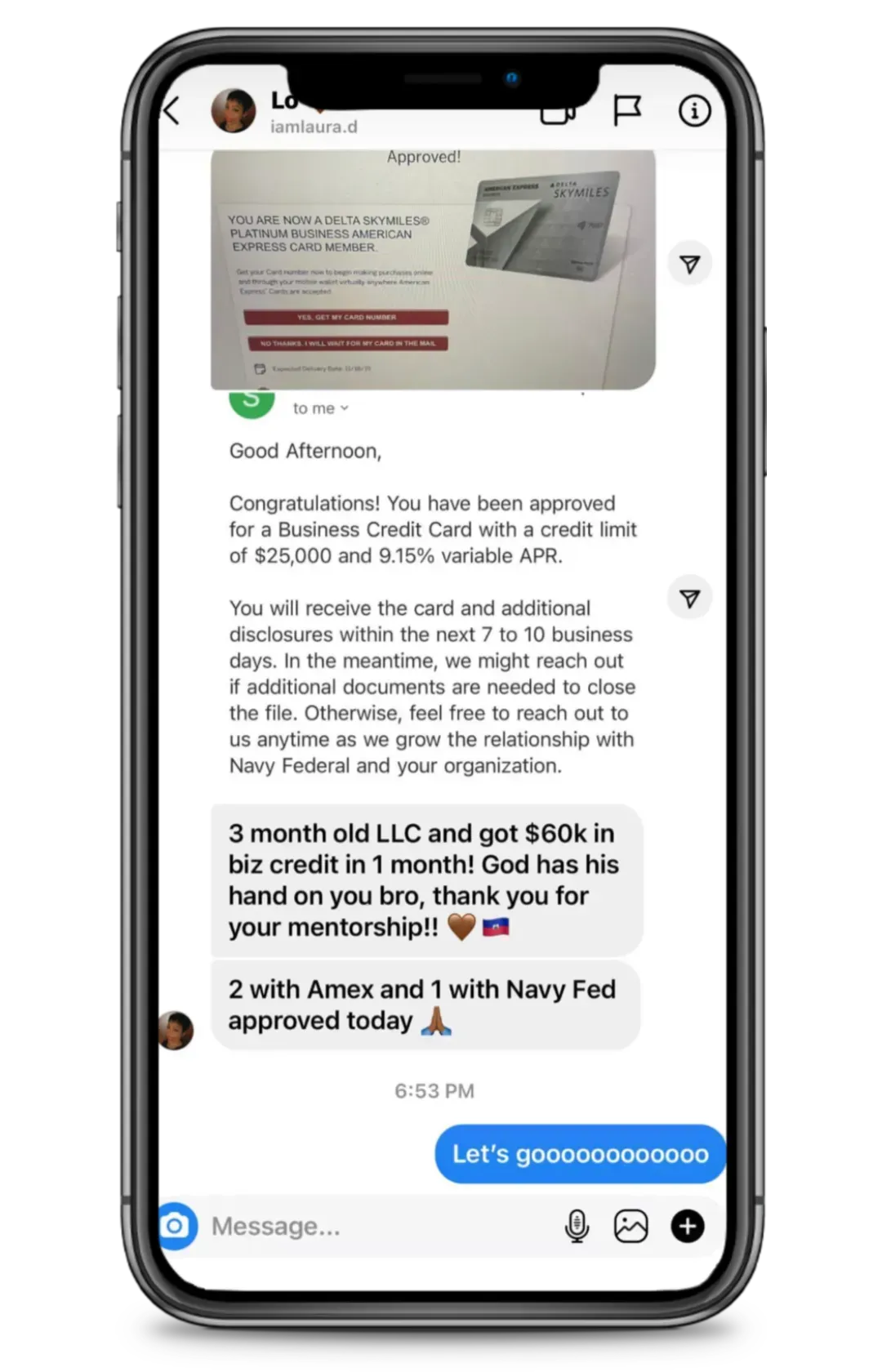

Expert Guidance & Support

Our experienced credit consultants are your partners in financial success. With their expertise and insights, you’ll gain the knowledge and strategies needed to manage your credit effectively and strengthen your creditworthiness.

Dispute & Correction Service

Say goodbye to credit report inaccuracies. We carefully uncover and correct errors, disputing unfair marks so your credit score accurately reflects your true financial integrity.

Smart Investment

Getting started is simple with our straightforward pricing just a one-time investment of $497. No ongoing commitment, and you can cancel at any time.

The Process

Here is the onboarding and service process you can expect when working with us

How long does the Credit Restoration process take?

Everyone's credit situation is completely different, so how long it takes for you to achieve your expected results depends on the number of derogatory credit items on your reports, your participation in getting credit reports to us, and the level of credit bureau cooperation. We will do our part moving as aggressively as possible auditing and creating dispute letters based on your reports usually within 24-48 hours after receiving them.

How Much Will This Increase My Credit Score?

Many of our clients have seen an increase of 100 points or more*; however, the actual amount will vary per customer. There are many factors that affect a credit score besides derogatory items. For example, the ability to pay down revolving debt, the type of credit you have, your length of credit history, even the number of inquiries on your credit file. It is especially important that no current accounts fall into a negative status.

How long does it take for the credit agencies to respond once I send them my dispute letter?

Typically, you can expect updated credit reports from all three bureaus within 30 to 45 days. Once received, you'll see which items have been removed and will need to send the originals to us for further action on remaining issues. It's crucial to forward all bureau correspondence promptly, as you'll be aware of deletions before us. If there's no response from the credit agency, don't worry; a new dispute letter will be generated during the processing center's review every 60 days.

How Can I Check My Progress?

You will have access to a secured portal. Every 30 days, your file will be reviewed. Based on the documentation received from you, (credit report updates and letters from creditors) a new dispute will be generated.

Facebook

Instagram

Youtube

TikTok